Tucson Down Payment Assistance Programs & 3% Down Loans: The First-Time Buyer’s Guide

Buying your first home in Tucson is a major milestone, but the upfront costs can often feel like a barrier. The good news is that Tucson down payment assistance programs and low down payment mortgage options can turn a significant financial hurdle into a manageable path. With the right strategy, you might get the keys to your new home sooner than you expected.

Have questions about the Tucson real estate market?

Get expert guidance tailored to your situation.

Schedule a free consultation →

Table of Contents

Why a Large Down Payment Isn’t Always Necessary

Many first-time buyers operate under the misconception that they need 20% down to buy a home in Tucson. That belief often keeps people renting for years longer than necessary. In reality, with Tucson down payment assistance programs and modern 3% down loans, you may be able to purchase a starter home with significantly less cash upfront.

Considering the current market, here is why exploring these options matters right now:

- Rising Rents in Tucson: Rent increases can quietly erode your ability to save. Owning a home allows you to lock in your housing costs and build equity instead of paying off your landlord’s mortgage.

- Market Fluctuations: Waiting until you save a massive down payment can backfire if home prices or interest rates rise. As noted in the Tucson July 2025 Housing Market Report, understanding pricing trends is crucial to timing your purchase correctly.

- Assistance Availability: Funding for programs like the Pima Tucson Homebuyer’s Solution or Home Plus can be finite. These programs often have annual caps, meaning funds are available on a first-come, first-served basis.

Your goal is to utilize the right mix of assistance and low down payment financing to preserve your savings for emergencies while securing a home that fits your budget.

Types of Tucson Down Payment Assistance Programs

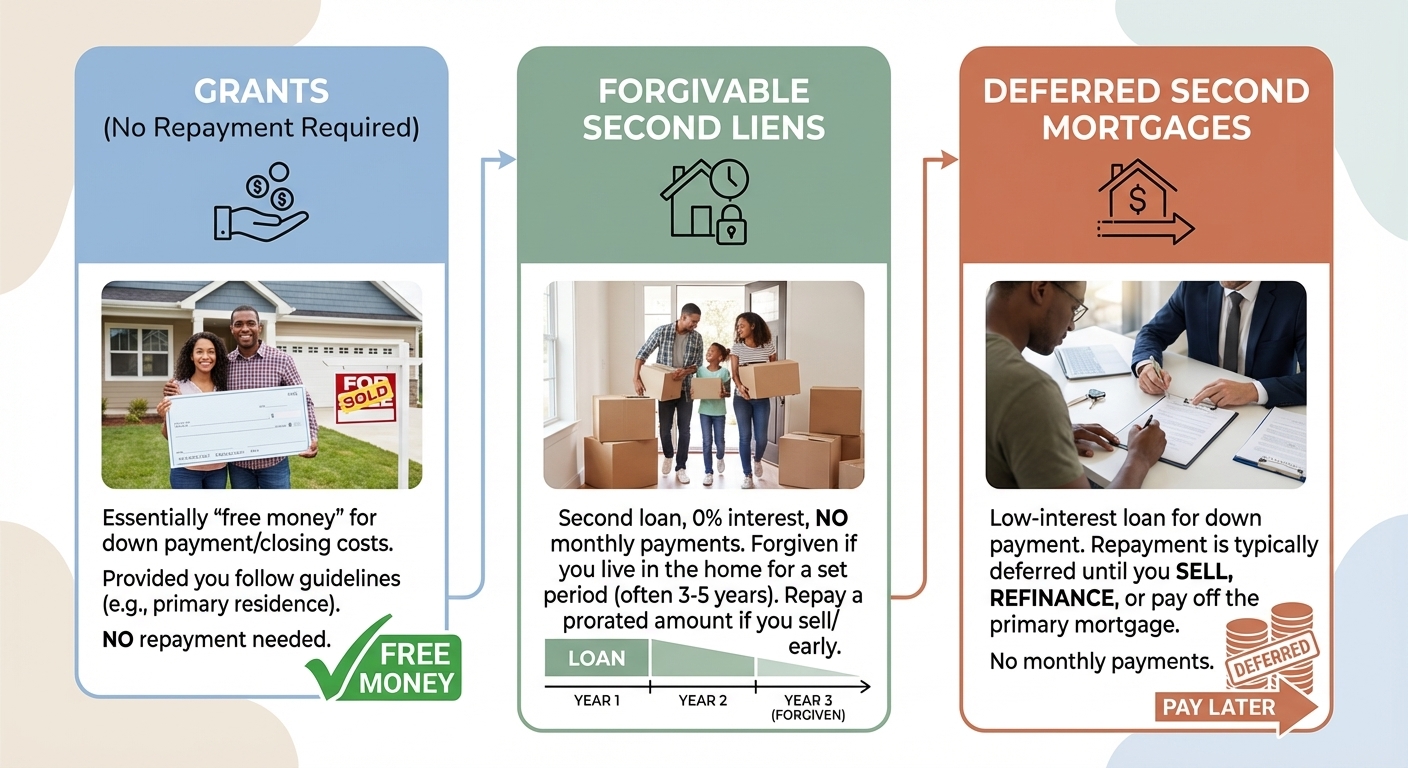

While specific offers change based on funding cycles, most Tucson down payment assistance programs generally fall into three categories. It is essential to confirm current availability with your lender and the team at Moyer Realty Services.

- Grants (No Repayment Required): Some programs offer genuine grants to cover a portion of the down payment or closing costs. This is essentially “free money” that does not need to be repaid, provided you adhere to program guidelines, such as occupying the property as your primary residence.

- Forgivable Second Liens: Other programs provide a second loan recorded against the property with 0% interest and no monthly payments. If you reside in the home for a set period (often 3 to 5 years), the loan is forgiven. However, if you sell or refinance early, you may need to repay a prorated amount.

- Deferred Second Mortgages: These are low-interest loans used to cover your down payment. Repayment is typically deferred until you sell the home, refinance, or pay off the primary mortgage.

Common eligibility requirements for these programs include:

- Income Limits: Many programs are designed for low-to-moderate-income buyers. Eligibility is often based on the Area Median Income (AMI) for Pima County, adjusted for family size.

- Debt-to-Income Ratio (DTI): Lenders will look at your monthly debt obligations relative to your gross income to ensure the mortgage is affordable.

- Homebuyer Education: Completion of a HUD-approved homebuyer education course is frequently required. This class ensures you understand budgeting, maintenance, and the responsibilities of ownership.

According to HUD.gov, these counseling programs are critical for long-term homeowner success. A knowledgeable lender can help match your financial profile with the strongest assistance options available.

Combining Assistance with 3% Down Loans

Even without grants, a 3% down conventional loan (such as the Conventional 97 or HomeReady programs) can be a powerful tool. When you layer these loans with Tucson down payment assistance programs, homeownership becomes far more accessible.

Real-World Scenario: Buying a Tucson Starter Home

Let’s look at a hypothetical example of a $320,000 home in a Tucson neighborhood.

- Standard 3% Down Payment: 3% of $320,000 is $9,600. You would also need to cover closing costs, which typically range from 2% to 4% of the purchase price.

- With $10,000 in Assistance: If you qualify for $10,000 in assistance, those funds could cover your entire down payment requirement.

- Your Out-of-Pocket Costs: Instead of needing nearly $15,000 or more upfront, you might only need to bring a few thousand dollars to closing to cover remaining fees and inspections.

Keep in mind that low down payment loans usually require private mortgage insurance (PMI), which will slightly increase your monthly payment. However, for many buyers, this is a worthwhile trade-off to stop renting and start building equity.

Common Pitfalls to Avoid

- Chasing the Highest Dollar Amount: The program with the most money isn’t always the best fit. Some come with higher interest rates or stricter repayment terms that could complicate your finances later.

- Ignoring Total Monthly Cost: Focus on your monthly affordability, not just the cash to close. Ensure your budget can handle the mortgage payment, utilities, and maintenance.

- Skipping Inspections: Never try to save money by waiving the home inspection. This is your best protection against buying a property with hidden, expensive defects.

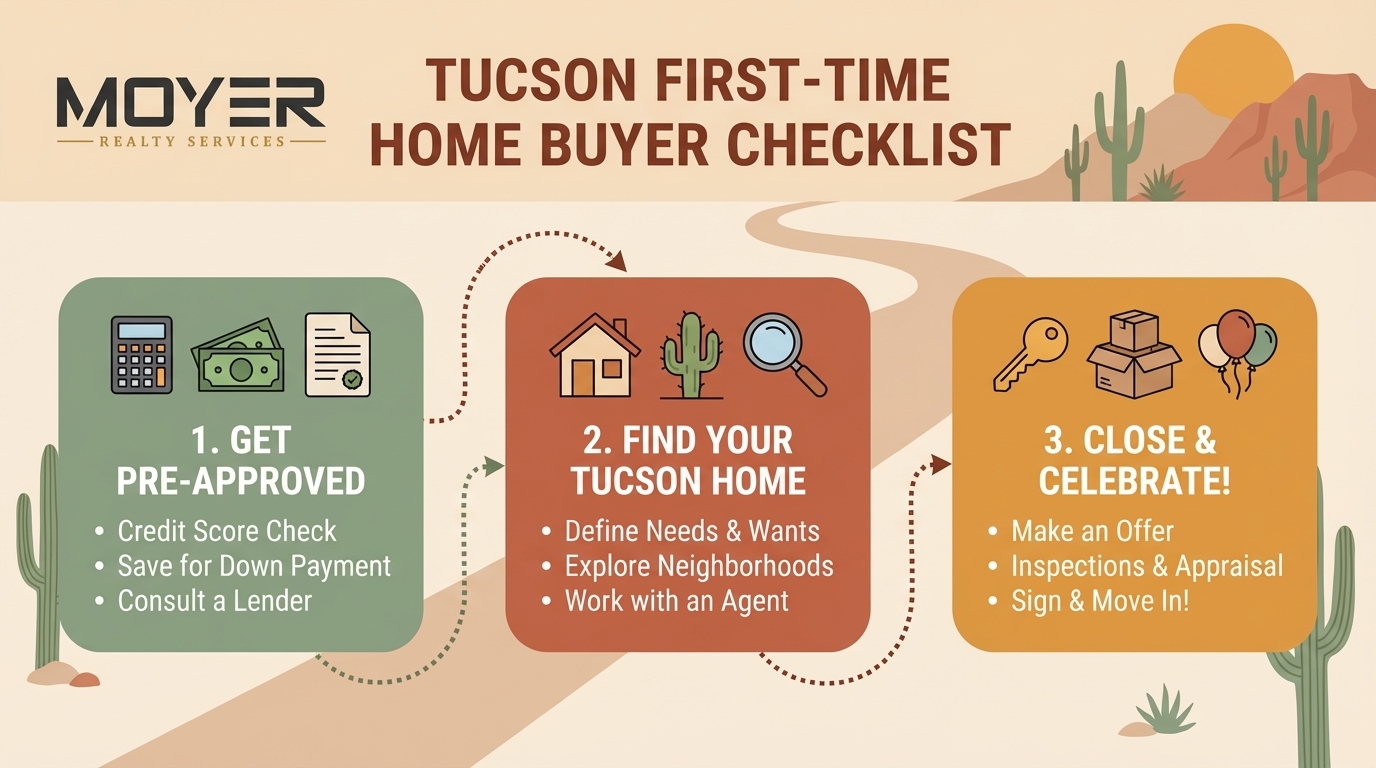

Your Roadmap to Homeownership in Tucson

Follow this simple path to use Tucson down payment assistance programs effectively.

- Assess Your Finances: Review your credit score, savings, and current debts. Before you start shopping, read our guide on Mortgage Pre-Approval for First-Time Tucson Home Buyers to understand the documentation you will need.

- Consult a Local Lender & Moyer Realty Services: A lender can verify your eligibility for specific programs like Home Plus. Moyer Realty Services can help you identify neighborhoods that fit your approved price range.

- Complete Required Education: If your program mandates a homebuyer class, complete it early. It is a valuable resource that empowers you as a buyer.

- Shop Strategically: Tour homes that meet program guidelines. We look for properties that are structurally sound and move-in ready to ensure they pass necessary appraisals.

- Negotiate with Confidence: We will help you structure an offer that protects your interests, including inspection contingencies and appropriate closing timelines.

How Moyer Realty Services Guides You Home

Navigating the various Tucson down payment assistance programs and loan options can be complex. Without professional guidance, it is easy to miss deadlines or misunderstand program rules, potentially jeopardizing your funding.

The team at Moyer Realty Services has deep experience with local market conditions and buyer programs. We help you:

- Identify Opportunities: Match your financial profile with the right assistance programs and properties.

- Avoid Eligibility Traps: Steer clear of homes or contract terms that might disqualify you from receiving assistance.

- Close Smoothly: Coordinate with your lender and title company to ensure all program requirements are met on time.

Ready to explore your options? Contact Moyer Realty Services now to see if you qualify for low down payment solutions.

Frequently Asked Questions

Answers to common questions about Tucson down payment assistance.

Not necessarily. While many programs target first-time buyers (defined as someone who hasn’t owned a home in the last three years), some options like the Home Plus program may be available to repeat buyers who meet specific income and purchase price limits. Always check current guidelines with Moyer Realty Services and your lender.

Yes, in many cases. Several Tucson down payment assistance programs allow you to apply the funds toward both the down payment and eligible closing costs. This can significantly reduce the amount of cash you need to bring to the closing table.

Credit requirements vary by program and lender, but a score of 640 or higher is a common benchmark for many down payment assistance options. Some FHA-based programs may accept lower scores, though they might come with different terms. Improving your credit score before applying can open up more favorable options.

If you use a program with a forgivable second lien and you sell, refinance, or move out before the forgiveness period (often 3-5 years) is over, you will typically have to repay a portion of the assistance. It is important to discuss your long-term plans with Moyer Realty Services to choose the program that best fits your timeline.