VA Loan Limits in Arizona (2026): Tucson Buying Power, Jumbo, Entitlement & Down Payments

VA loan limits in Arizona didn’t disappear — they just don’t work the way most people think. If you’re shopping in Tucson and hearing “no limits” from one person and “you’ll need money down” from another, this guide explains exactly when limits matter, when they don’t, and what changes when a lender treats your file like a jumbo loan internally.

Quick Navigation

The biggest misunderstanding is the “no limits” line. Yes, many Veterans can buy with $0 down in the right scenario. But “no limits” doesn’t mean every lender treats a $800,000 purchase the same as a $400,000 one. In Tucson, especially in higher-price areas, what changes is usually entitlement math (full vs. partial), lender overlays, and your total cash-to-close (closing costs, funding fee, and sometimes reserve requirements or appraisal-gap risk).

Important nuance: the VA removed the old hard loan cap in 2020 for buyers with full entitlement. What changes year to year is the conforming loan limit lenders use as a reference point — and that’s where “jumbo-style” overlays tend to show up.

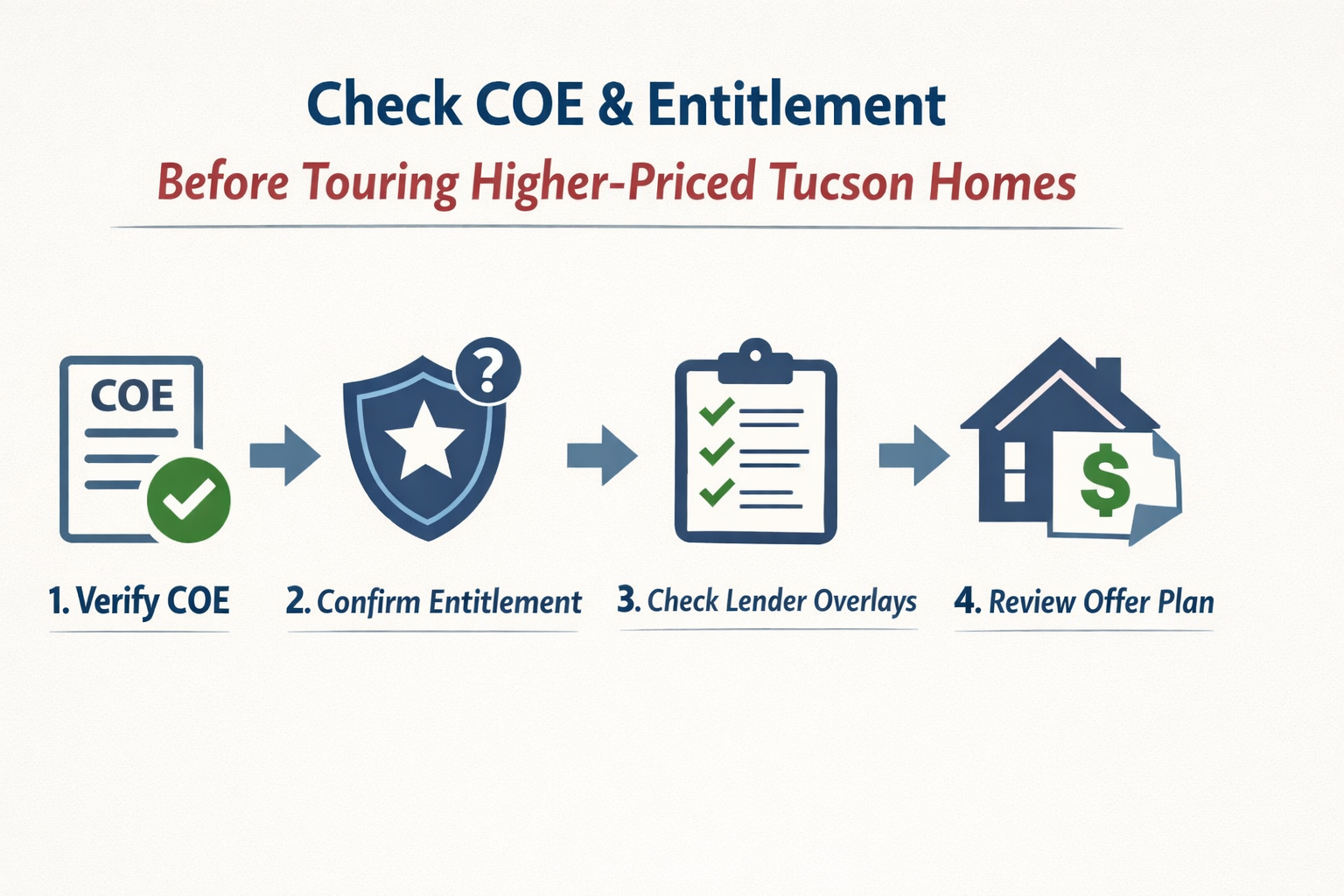

If you confirm your COE/entitlement early, you’ll know whether you’re truly in the “$0 down” lane before you fall in love with a house.

Confirm Your COE Early

Know your full vs. partial entitlement before you tour, so your lender can flag jumbo overlays and estimate cash-to-close accurately.

This guide is for Tucson-area Veterans who want a larger home and don’t want surprises once they go above typical price points. You’ll learn how entitlement, county limits, and lender overlays affect your options, plus what to verify on your COE before you start touring.

- Separate “limits” from real buying power

Understand what VA limits actually apply to (and what they don’t). - Know when the county limit still matters

Especially if you have partial entitlement: or an existing VA loan. - Compare VA “jumbo” vs. conventional jumbo

The practical tradeoffs: underwriting, reserves, rates, and cash-to-close expectations. - Estimate cash-to-close realistically

Closing costs, funding fee, and possible reserves/appraisal-gap planning in Tucson price ranges.

VA loan limits in Arizona (2026): the real answer for Tucson buyers

But you’ll still hear people mention county loan limits when talking about VA loan limits in Arizona. Here’s when they actually matter:

- You still have an active VA loan (your entitlement is tied up).

- A prior VA loan wasn’t fully restored yet.

- Restoration got complicated (for example, a short sale or foreclosure scenario).

In those cases, lenders may use the county conforming limit as part of the VA guaranty/entitlement math, which can change whether a down payment is required.

What’s the number many lenders reference in 2026? The conforming loan limit set by FHFA for loans Fannie Mae and Freddie Mac can acquire. In most U.S. counties, the 2026 baseline for a 1-unit home is $832,750.

Even though VA loans follow VA program rules, many lenders treat loans above the conforming limit as “jumbo” internally. That can mean extra documentation, higher reserve expectations, or stricter underwriting (overlays). The key point: those are lender policy decisions, not a new VA rule.

Source context: FHFA sets annual conforming loan limits for Fannie Mae and Freddie Mac (conventional loans). VA loans aren’t “conforming,” but lenders often use conforming thresholds as an underwriting and pricing reference point.

Verify your county limit here: FHFA county map.

Tucson buying power: entitlement vs. “limits” (full vs. partial)

This matters because it answers the most common objection I hear from upgrade buyers: “I can’t afford an $800k home.” Sometimes that’s true, but just as often, the real issue isn’t the sales price. Most “I can’t afford it” situations come down to monthly payment comfort, residual income, and reserves — not a generic “VA loan limits in Arizona” number.

What can improve borrowing power quickly?

- Pay off (or refinance) a high payment (car, consolidation, personal loan)

- Reduce revolving utilization (even a 30–45 day plan can move DTI)

- Change the deal structure (rate buydown, seller concessions, term options)

- Time the purchase around a known income change (PCS, promotion, retirement pay start date)

For VA loans, lenders commonly evaluate more than DTI. VA underwriting emphasizes residual income, and on higher loan amounts lenders may add their own overlays. The VA Lenders Handbook (VA Pamphlet 26-7) is the foundational reference for the program.

Here are the four factors that usually decide whether a higher-price VA purchase feels smooth or stressful:

- Monthly payment comfort

$0 down can be possible, but the payment still has to fit real life — not just a quick online estimate. - Residual income + overall debt

VA often hinges on what’s left after obligations, especially at higher loan amounts. - Entitlement status on your COE

Full vs. partial entitlement can change whether a down payment shows up above certain thresholds. - Property + appraisal risk

Foothills premiums, views, or ultra-custom finishes can increase appraisal-gap risk and change negotiation strategy.

In other words: you can be “eligible” for VA financing and still feel squeezed if your borrowing power is limited by lifestyle costs, HOA, or payment comfort. The goal is to build the approval around your upgrade goals, not around a myth.

When county conforming limits still matter for VA loans in Arizona (and why lenders care)

Tucson’s luxury inventory isn’t just bigger — it’s priced for views, lot placement, privacy, and trail access (especially in the Foothills). Those premiums can push a purchase into ranges where lenders get more conservative, even when the VA program stays flexible.

Want to see what’s happening right now in Tucson (inventory, pricing, and days on market)? Read our latest Tucson housing market update.

This is where buyers get surprised. They hear “VA = $0 down” and assume price doesn’t matter. With full entitlement, VA typically doesn’t require a down payment just because the price is high. The surprises usually come from lender overlays when a file gets treated like a jumbo loan, even though the VA rules didn’t change.

Get a Foothills Budget Check

Know your realistic cash-to-close range (closing costs + funding fee + any lender reserve expectations) and your plan for appraisal-gap risk before bidding on premium views.

If your plan includes extra cash-to-close, it helps to know what Tucson buyers use to bridge the gap—see Tucson down payment assistance programs.

Here are common scenarios where “jumbo-style” treatment shows up (these are lender overlays, not VA program requirements, and they vary by lender):

- Partial entitlement: If entitlement is tied up, a down payment can appear above certain price points.

- Loan amount above the conforming threshold: Some lenders add overlays like extra reserves, tighter credit, or more documentation.

- Complex appraisal risk: Unique properties can create appraisal gaps that affect strategy and cash-to-close.

- Condo + HOA factors: Insurance, budgets, or litigation can complicate financing and add scrutiny.

Local Tucson nuance: Foothills “retreat” homes often require more documentation than a tract-home file. Start with a strong mortgage pre-approval and a clear cash-to-close plan.

This doesn’t mean the deal is a trap. It means you should verify entitlement early and build a strategy that matches underwriting reality.

VA “jumbo” vs. conventional jumbo: what actually changes in underwriting

When Tucson buyers hear “jumbo,” they often assume the VA option disappears and they must switch to a conventional jumbo with a large down payment. That’s not automatically true.

In practice, “VA jumbo” usually means a VA loan that a lender treats as jumbo internally, often because the loan amount is above a conforming threshold. The VA rules may still apply, but lenders can add overlays (extra documentation, higher reserve expectations, or tighter credit standards). This is where confusion around VA loan limits in Arizona creates bad decisions, because the “limit” isn’t the same thing as approval.

Conventional jumbo isn’t “worse” — it’s just a different cost and underwriting model. Here’s what changes:

- Down payment expectations

With full entitlement, VA can allow $0 down even at higher prices, though overlays may still apply. Conventional jumbo often expects a down payment (varies by lender and borrower profile). - Monthly cost structure (MI vs. VA funding fee)

VA loans don’t have monthly mortgage insurance. Some borrowers pay a VA funding fee (often financeable; exemptions apply). Conventional jumbo may avoid MI with enough down payment, but pricing can shift via rate/points. - What underwriting “cares about” most

VA underwriting emphasizes residual income and ability to repay. Jumbo underwriting often leans harder on cash reserves, liquidity, and tighter credit criteria, especially at higher loan amounts. - Appraisal and property complexity

Both can finance luxury homes, but as prices rise lenders may be stricter, especially with Foothills view premiums and limited comparable sales, which can affect appraisal risk and negotiation strategy.

Practical takeaway: If you want to preserve cash for renovations, moving costs, or reserves, a VA loan with jumbo-style overlays can still be worth exploring. If overlays are restrictive or your income profile fits better elsewhere, a conventional jumbo may be cleaner.

The right choice usually comes down to your COE entitlement, your monthly comfort, and the lender’s overlay requirements.

Cash-to-close on an $800k Tucson home: how to estimate it without getting burned

When someone says, “I cannot afford an $800k home,” I usually ask one follow-up question: do you mean you cannot afford the price, or you cannot afford the payment and cash to close?

This is also where people misunderstand VA loan limits in Arizona, because the “limits” conversation distracts from what actually drives your monthly payment and cash-to-close number.

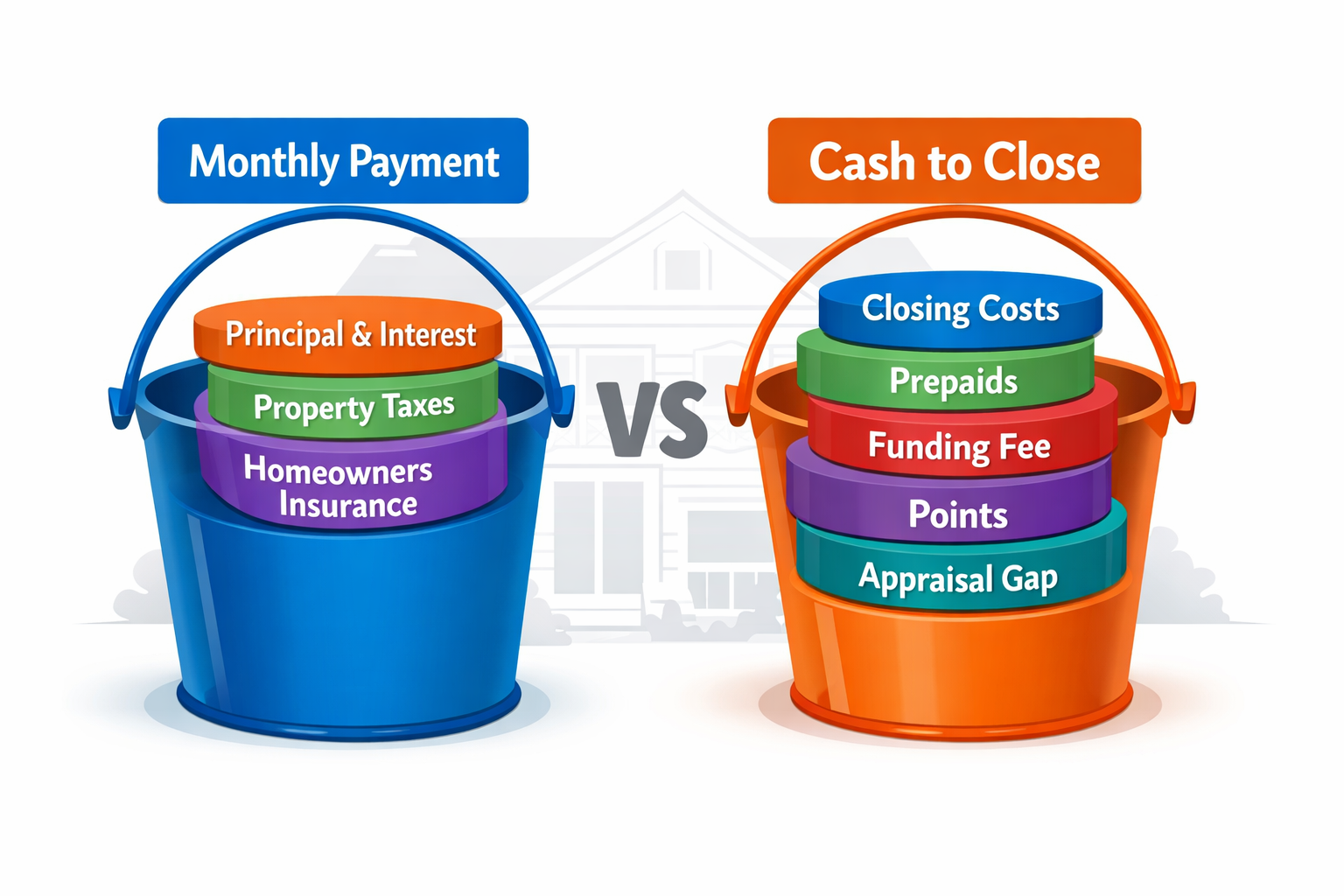

A purchase price is just a label. Your monthly payment is a bundle of:

- Principal and interest

- Property taxes (varies by property and exemptions)

- Homeowners insurance (varies by carrier and coverage; flood insurance depends on the home)

- HOA dues (if applicable)

- Mortgage insurance (typically not on VA loans, but relevant on many conventional loans)

Interest rates, insurance costs, and property taxes can change your payment meaningfully, so it’s risky to make an affordability decision based on a single online estimate.

Instead, treat affordability like a range you can live with while still saving, investing, and enjoying Tucson life.

Just as important: cash-to-close is a different bucket than the monthly payment. It commonly includes:

- Closing costs (lender + title/escrow fees; varies by lender and points)

- Prepaids (initial escrow deposits for taxes/insurance, plus daily interest)

- VA funding fee (if you’re not exempt; often financeable)

- Discount points or a rate buydown (optional)

- Appraisal-gap cash (only if the appraisal comes in low and you choose to bridge it)

One clarification: if your lender requires reserves (for example, a few months of PITI), that’s usually not money you “pay at closing.” It’s cash you may need to document and keep available after closing based on the lender’s overlay rules.

If you want a quick planning framework, use an estimate-based approach, not a promise:

- Ask your lender for two scenarios

A conservative monthly payment and an upper-limit monthly payment, both using realistic estimates for Tucson taxes and insurance. - Ask for a cash-to-close range

Request a range for (a) no seller concessions, (b) seller concessions, and (c) a rate buydown. - Stress-test both payments

Run each option through your real budget. Include lifestyle costs and your savings goals. - Set your comfort ceiling before you tour

If the upper-limit scenario makes you tight, you’re shopping too high, regardless of what the purchase price says.

This approach gives you a calm path to upgrade shopping instead of a stressful sprint where you fall in love with a charming home and then discover the payment is a bad surprise.

In practice, many Veterans improve buying power without adding risk by aligning timing (bonuses, PCS allowances, spouse income start dates) and reducing recurring debt. Even a $300–$500/month shift in recurring obligations can materially change DTI and residual income evaluations.

Confirm your COE early: how to verify entitlement before touring

The biggest mistake buyers make with VA loan limits in Arizona is confusing “limits” with borrowing power. The second is assuming they have full entitlement without confirming it.

Your Certificate of Eligibility (COE) shows your VA loan entitlement status. If you’ve used your benefit before, the COE can reflect that, and the details matter when you’re targeting higher-priced Tucson homes.

Learn how COEs work and how to request one from the VA: VA home loan COE guidance.

- Get your COE before you tour higher-priced homes

Pull it early so you can fix errors, request updates, or document restorations before you’re under contract. - Full vs. partial entitlement: If it’s partial, ask your lender how it affects $0 down at your target price range, and what cash-to-close they want you to plan for.

- Ask what “jumbo” means at your lender

“VA jumbo” is lender language, not a VA program category. Ask what overlays they apply (reserves, documentation, credit thresholds). - Build a Foothills-ready offer strategy

Premium-view homes often require cleaner terms and tighter timelines. Knowing your real approval structure helps you negotiate confidently. - Coordinate your agent and lender plan

Align COE status, cash-to-close range, appraisal risk, and offer terms before you start writing — so you’re not improvising mid-escrow.

Checking your entitlement early isn’t busywork — it’s how you avoid a surprise down payment or cash-to-close requirement after you’re emotionally attached to a home.

Plan Your Offer With Confidence

Align COE status, cash-to-close, and terms before you write.

References

FHFA 2026 conforming loan limits news release: https://www.fhfa.gov/news/news-release/fhfa-announces-conforming-loan-limit-values-for-2026

FHFA county loan limit map: https://www.fhfa.gov/data/dashboard/conforming-loan-limit-values-map

VA Lenders Handbook (VA Pamphlet 26-7): https://www.benefits.va.gov/WARMS/pam26_7.asp

VA COE and application overview: https://www.va.gov/housing-assistance/home-loans/how-to-apply/

VA funding fee overview: https://www.va.gov/housing-assistance/home-loans/funding-fee-and-closing-costs/

Join The Discussion