Tucson First-Time Home Buyer Checklist: 5 Myths That Could Derail Your Move

Buying your first home in Tucson should be an exciting milestone, not a nightmare of confusing rules and bad advice. Yet, many aspiring homeowners start their journey with a generic Tucson first-time home buyer checklist found online, only to discover that it is packed with myths that can quietly derail their move before they ever get the keys.

Quick Navigation

This guide breaks down the most dangerous myths on the typical Tucson first-time home buyer checklist, then gives you a simple, practical path so you can move into a beautiful home with confidence.

Why Generic Checklists Fail in Tucson

Most first-time buyers in Tucson start with Google searches and generic checklists. On the surface, those lists look helpful. But they rarely match real Tucson prices, local salaries, or the specific loan options available in Pima County.

Here is the problem: if you follow bad advice, you may wait years to save the wrong amount of money, shop in the wrong price range, or overlook financial help that could make your move possible now. That is how innocent myths quietly kill your momentum.

Instead, you need a Tucson-specific plan that reflects our unique market of starter homes, townhomes, and cozy desert retreats in neighborhoods from the University area to Rita Ranch and Oro Valley.

5 Tucson First-Time Home Buyer Checklist Myths to Avoid

Let us expose the worst myths that show up on almost every generic checklist and replace them with local reality.

Myth 1: You Must Have 20% Down to Buy in Tucson

This is one of the biggest deterrents for new buyers. The old rule of 20% down simply does not match how most people purchase homes today, especially with the variety of Tucson down payment assistance programs available.

- FHA and Low-Down Loans

Many Tucson first-time buyers use FHA loans with as little as 3.5% down, or even 3% down on certain conventional loans. According to HUD guidelines, these programs are designed specifically to help credit-worthy buyers enter the market sooner. - Local and State Assistance

Arizona programs like Home Plus can help cover part of your down payment or closing costs if you qualify. - Real Tucson Example

On a $325,000 home, 20% down is $65,000. But 3.5% down is only $11,375. That big gap is why waiting for 20% can be a costly delay while home prices rise.

Yes, 20% down avoids Private Mortgage Insurance (PMI), but waiting years while Tucson values appreciate can cost more than paying a small monthly premium now.

Myth 2: An Online Pre-Approval Is Enough

Online checklists often say “Get a pre-approval” and call it done. In Tucson’s competitive neighborhoods, relying solely on an automated letter can be a trap.

- Local lender knowledge matters

A strong local lender understands Tucson appraisals, desert property conditions, and common HOA issues that can slow loans. They also calculate your debt-to-income ratio accurately so you aren’t surprised later. - Fully underwritten approval is stronger

Some buyers get fully underwritten approvals before they shop. This signals to sellers that your financing is solid, making your offer nearly as strong as cash. - Different loans fit different homes

Some Tucson townhomes, manufactured homes, or fixer-uppers do not qualify for every loan type.

Working closely with your lender and Moyer Realty Services helps you match the right loan to the right home so there are no ugly surprises after you fall in love with a gorgeous desert property.

Myth 3: The List Price Is the Right Offer Price

Many checklists tell you to compare list prices and pick something in the middle. In real Tucson neighborhoods, that can be a risky guess. The list price is just a marketing number; the true value is determined by the market.

- Some areas are still competitive

In popular parts of Tucson, like Sam Hughes or near the U of A, attractive homes can still receive multiple offers. You need to know current market conditions before writing a contract. - Other areas may be more flexible

In slower pockets, you might negotiate closing costs, repairs, or even a lower price. - Comparative Market Analysis (CMA)

Serious decisions should be based on a CMA of similar homes that actually sold in the last 3 to 6 months, not just on asking prices.

The team at Moyer Realty Services studies these patterns daily, so you are not guessing during one of the biggest money decisions of your life.

Myth 4: A Home Inspection Is Optional in the Desert

Some quick checklists treat inspections like a “nice to have.” In the desert, that is a dangerous myth. The Arizona BINSR (Buyer’s Inspection Notice and Seller’s Response) process is your opportunity to request repairs, but only if you find the issues first.

- Age and condition really matter

Tucson homes can have older roofs, aging AC units, and unique issues like polybutylene pipes that you cannot see in a quick showing. - Desert-specific concerns

Inspections can uncover things like past roof leaks, termite history, or drainage problems from monsoon storms. - Negotiation leverage

A detailed inspection report often gives you power to request repairs or credits so you are not stuck with surprise bills.

Skipping an inspection to “save money” is one of the worst mistakes a buyer can make. A few hundred dollars now protects your investment for decades.

Myth 5: You Should Max Out Your Loan Approval

Many buyers think their approval amount is their budget. That shortcut can turn your new home into a financial trap, making you “house poor.”

- Your lifestyle matters

Maybe you love summer trips to Mount Lemmon, dining in downtown Tucson, or saving for future dreams. A smaller payment can protect that lifestyle. - Hidden monthly costs

Beyond principal and interest, you will pay property taxes, insurance, utilities, HOA fees, and Tucson summer cooling bills. - Comfortable budget first

Decide your comfortable monthly payment before you shop, then let that guide your price range.

A cozy Tucson home that leaves room in your budget is usually better than a big house that feels tight every month.

Real Numbers: How Tucson First-Time Buyers Actually Buy

Here is an example of how a realistic purchase might look for a first-time buyer in Tucson, Arizona. These are sample numbers for learning only, not quotes.

- Purchase price

$300,000 starter home in a welcoming Tucson neighborhood. - Down payment

3.5% down FHA loan means about $10,500 down. - Closing costs & Prepaids

Roughly 2% to 3% of the price (approx. $6,000 to $9,000), covering title fees, lender fees, and escrow accounts. These can sometimes be partly covered by seller credits. - Earnest Money Deposit

Typically 1% of the purchase price ($3,000) deposited shortly after offer acceptance to show good faith. This applies toward your down payment.

When you compare this to rising Tucson rents, owning a bright, inviting home can be closer than you imagine, especially if you stop believing the old myths.

Adopting a Smart Mindset for Your Tucson Home Search

Instead of trying to follow a generic checklist, think of your Tucson home search as building a custom roadmap to your own desert haven.

- Focus on comfort, not just approval amounts

Choose a payment that lets you enjoy Tucson life instead of worrying every month. - Use Tucson-specific advice

Lean on local data, recent sales, and guidance from Moyer Realty Services, not random national averages. - Think long term

Choose a neighborhood that will feel like a tranquil, welcoming retreat for years, not just a quick fix.

With the right mindset, your first home can be more than a transaction. It can be the cozy retreat where you build memories, enjoy stunning sunsets, and create your Tucson story.

Your Action Plan for a Successful Tucson Move

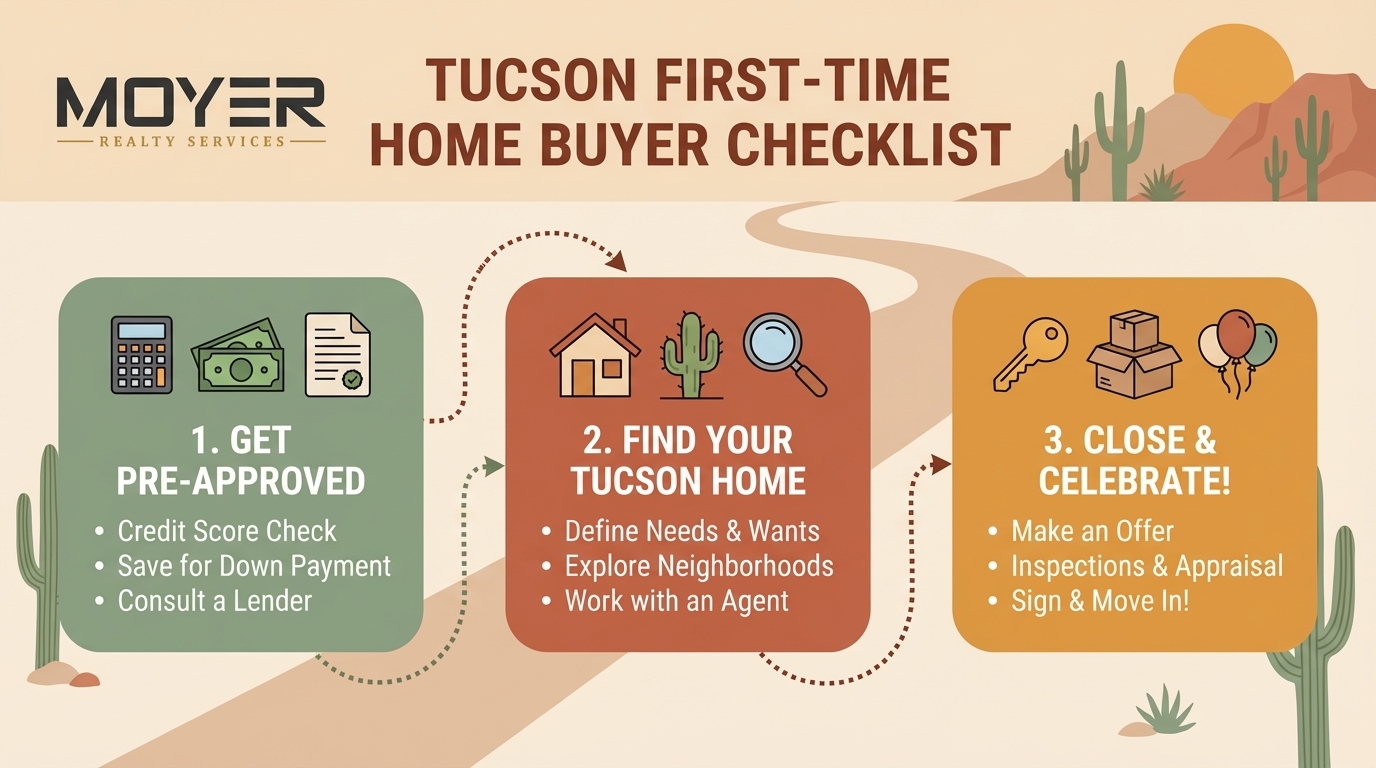

Here is a simple action plan you can start today that avoids the worst Tucson first-time home buyer checklist myths.

- Define your monthly comfort zone

List your income, debts, and lifestyle costs. Decide on a monthly payment range that still leaves room for savings and fun. - Talk to a local lender early

Ask about FHA, conventional, VA, and assistance programs that fit Tucson buyers. Request a full breakdown of total cash needed, not just the down payment. - Connect with Moyer Realty Services

Share your comfort range, target areas, and must-have features. The team will help you match bright, inviting Tucson homes to your real budget. - Tour homes with an inspection mindset

As you walk through properties, look beyond pretty staging and imagine how systems, roofs, and yards will hold up in Tucson weather. - Order a professional inspection

Never skip this step. Use the report and the BINSR process to negotiate repairs or credits so you do not walk into costly surprises. - Celebrate your Tucson move-in

Once you close, enjoy your cozy haven, personalize your spaces, and soak in those breathtaking desert sunsets from your own backyard.

Ready to Turn Tucson Dreams into Keys in Your Hand?

If you want a clear, myth-free roadmap that fits your real life, you do not have to figure it out alone.

Have questions about the Tucson real estate market?

Get expert guidance tailored to your situation.

Schedule a free consultation →

Contact Moyer Realty Services today to schedule a friendly, no-pressure consultation. The team will walk you through realistic numbers, neighborhood options, and a simple step-by-step plan so your move feels inviting and manageable, not overwhelming.

Frequently Asked Questions

Answers to common questions.

The old idea that you must save 20% of the purchase price is a myth. Many buyers purchase with 3% to 5% down, and some use FHA loans at 3.5% down. You will also need money for closing costs, usually around 2% to 3% of the price. A local lender can give you an exact estimate, and Moyer Realty Services can help you explore options where part of your costs may be covered by assistance programs or negotiated seller credits.

In many Tucson neighborhoods, monthly mortgage payments on a modest starter home are comparable to local rents, especially when factoring in tax benefits. The key difference is that your payment builds equity over time instead of going entirely to a landlord. Moyer Realty Services can help you compare a sample mortgage payment against your current rent to see if buying makes financial sense for you.

Yes, a professional inspection is essential. Tucson homes contend with intense sun, monsoon storms, and dust, which can affect roofs, HVAC systems, stucco, and drainage. An inspection allows you to use the Arizona BINSR process to request repairs before you close. Moyer Realty Services can recommend experienced local inspectors who know exactly what to look for in desert properties.

From the time you start your search, a typical timeline is 1 to 3 months to find a home and go under contract, followed by about 30 to 45 days to close the loan. The process can move faster if your pre-approval is fully underwritten. Partnering with Moyer Realty Services helps keep the timeline on track and avoids common delays.

Yes, many Tucson first-time buyers qualify even with student loans. Lenders look at your debt-to-income (DTI) ratio rather than just the total amount owed. Income-based repayment plans can sometimes help lower the monthly obligation calculated by the lender. It is best to speak with a loan officer early to understand your buying power.

Navigate the Tucson Market with Confidence

Buying or selling shouldn’t be stressful. Get clear, data-backed guidance tailored to your goals. No scripts, no pressure—just the honest advice you need to make the right move.

Serving Tucson, Oro Valley, Marana, Vail, Sahuarita, Green Valley, and surrounding communities.